We take the same powerful tools that a 6% commission agent uses, and make them available to you for a low, upfront price. Buy only what you want. Pay nothing more.

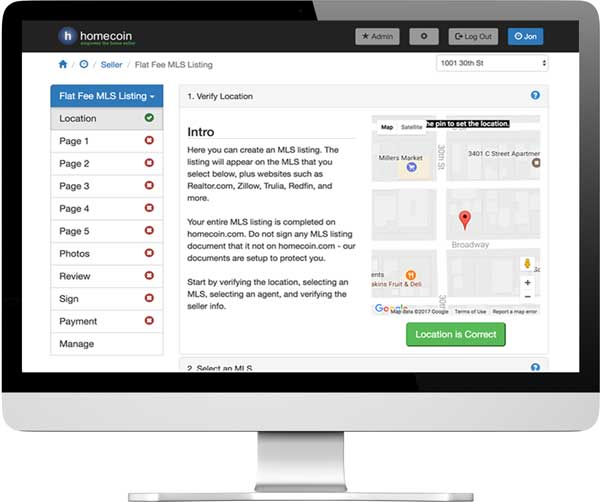

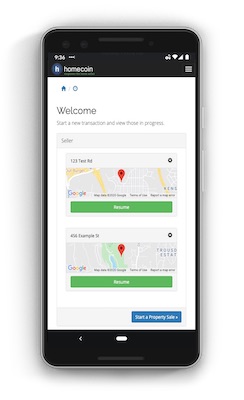

Your time is valuable. We use the power of software, so all of our tools are available 100% online. Have you ever listed on the MLS using your smartphone? With homecoin you can.

homecoin gives you powerful agent tools for a flat-fee.

"Consumers can save thousands of dollars in commissions (using flat-fee services)."

| For Sale By Owner |

|

Commission Agent |

|

|---|---|---|---|

| Cost Effective | |||

| Self Serve | |||

| Easy To Use | |||

| Powerful Tools |

| Service | Price | Details |

|---|---|---|

| Free Comparable Sales | FREE | |

| Free Home Value Report | FREE | |

| Flat Fee MLS Listing | $95 | |

| Lockbox Rental | $125 | |

| Pro Photography | Varies | |

| Sign Post Rental | $99+ | |

| Free Sign (w/ Post Rental) | FREE | |

| Free Open House Kit | FREE | |

| Free FSBO Listing | FREE | |

| Free Disclosures (w/ Flat Fee MLS Listing) | FREE | |

| Forms Help (Standard) | Varies | |

| Forms Help (Premium Seller) | Varies | |

| Buyer Commission Rebate | 25%-50% |

Upfront pricing.

Buy only what you want.

No hidden fees.

Shouldn't everything be this simple?

* All prices vary by MLS or location. Click here to get exact pricing for your area.

homecoin has already helped hundreds of home sellers save millions in commissions. Sign up today and see how easy it is to make the most money on your home sale!

All MLS listings include FREE call forwarding and info by text.

Never miss a lead.

Property info by text 24/7.

NEW!

Do you have questions about your home sale or purchase?

In our forum you can ask other sellers and buyers.

All MLS listings include FREE automatic email forwarding.

Receive instant email and text notifications for new emails.

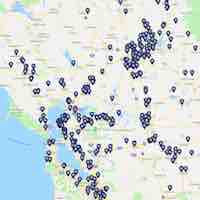

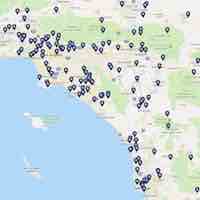

Important Note: If we serve your state and are not a member of the local MLS, we can often place your home on a nearby MLS which is as effective as the local MLS. Contact us here if you have questions.

The Multiple Listing Service ("MLS") is an agent-only database where agents list homes for sale and offer other agents a commission for finding a buyer. You can list on the MLS without paying a commission using homecoin.com. Learn more about the MLS.

1. The MLS enables a seller to offer a commission to buyers agents. If a commission is NOT offered, the buyer agent would have to ask their buyer to pay - this is a hard conversation that many buyer agents

will avoid if possible.

2. The MLS pushes home info to websites such as Realtor.com, Redfin, Zillow, Trulia, major brokerage sites, plus many others.

Simply put, if a seller pays a 6% commission to sell their home, typically half (3%) goes to the listing agent and half (3%) goes to the buyers agent.

Note that a 6% commission is not set in stone. The typical commission is 5.4% and will vary based on home value.

No. Some websites get you to list through them and then send the listing to a broker in your area, who then emails you a listing agreement and all the actual MLS forms to complete. We DO NOT do this. On homecoin, you select the agent that completes your listing and you complete all the correct forms and listing agreement on our website. No slow, offline, funny business.

Yes, with homecoin you will always be listed on the same Multiple Listing Service (MLS) that local agents use. We show you up front which MLSs you can list on for a flat fee through our website (there are over 500 MLSs in the US). It is absolutely critical you list on the correct MLS, and some websites will list you on the wrong MLS. We do not accept listings for MLSs that we are not able to get you listed on.

Yes. If you are offering a fair commission through the MLS (typically 2-3%), buyer agents will certainly show your property. Buyer agents only avoid homes that are not offering a commission through the MLS. By using the MLS, you are making a contractual offer to those buyer agents and you can offer them any amount you like.

Yes. It is very important to understand how a flat fee MLS listing works and how much time other websites will take from you. To list on the MLS, a seller needs to complete at least two forms: 1) listing agreement, and 2) the

actual listing input form for the MLS.

Other websites will either a) collect generic property information that you provided about your home, have you pay, and then refer you to an agent who will send you the

actual listing forms to complete / sign / scan / email, or b) use the information provided to complete the MLS listing, which is a tremendous disservice to you since all MLSs have very different fields to complete and your

home will not be as visible if you cannot complete all the actual MLS fields.

Yes, they are extremely common. It is estimated that 20% of real estate sales do not use a commission based listing agent. The US Department of Justice has a large section of its website dedicated to informing consumers how much they can save by doing flat fee (aka fee for service)

sales.

The real estate industry would like you to think that the only way to sell a home is by paying a full 6% commission, but that is just not true. Flat fee agents and real estate agents that accept less than 6% commission are

the norm. Home sellers can capture tremendous cost savings by understanding just a small amount of how real estate works (such as knowing they can list on the MLS for a flat fee).

For sale by owner (FSBO) means that you are not working with agents whatsoever, in any capacity. Only a real estate agent can list a property for a flat fee on the MLS, so you are technically no longer considered FSBO since

you paid the flat fee to have the property listed.

FSBO (not working with agents at all) is typically not successful because nearly 90% of buyers have an agent and that agent will only show your property if you are offering a commission through the MLS. Flat fee MLS solves

that problem while still giving the seller a cost savings from not using a commission based listing agent. In addition, the seller may find a buyer who does not have an agent which allows them to effectively pay zero

commission (except the original flat fee paid).